Forex trading signals are crucial tools for both novice and experienced traders. They provide valuable insights into market movements and potential trade opportunities. With the right signals, traders can make informed decisions to improve their success rates. In this article, we will delve into the concept of forex trading signals, the various types available, and how to effectively utilize them in your trading strategy. You can also explore a reliable option for trading on the forex trading signals Trading Platform TH.

Thank you for reading this post, don't forget to subscribe!What Are Forex Trading Signals?

Forex trading signals are trade recommendations generated by either manual analysis or automated software. These signals indicate when to enter or exit a trade based on specific criteria, such as price movements, technical indicators, or economic events. Traders rely on these signals to make quick decisions in the fast-paced forex market.

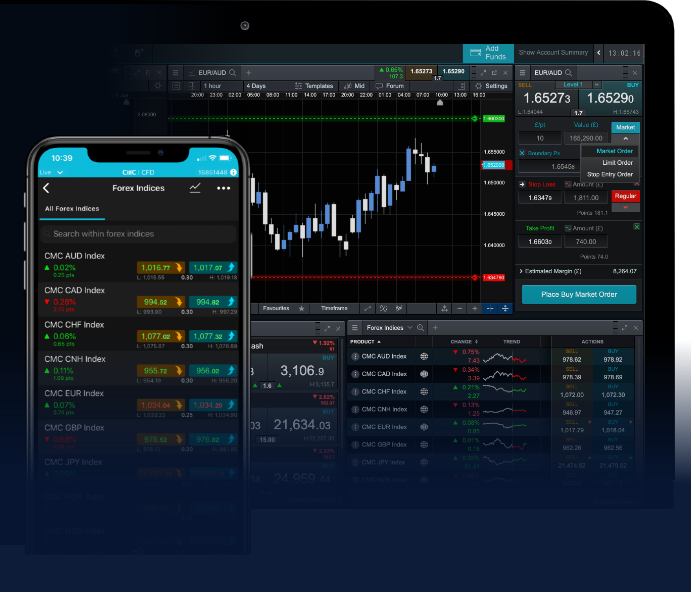

Signals can be delivered through various channels, including email, text messages, or mobile apps. By understanding the underlying factors that drive market movements, traders can leverage these signals to optimize their trading strategies.

Types of Forex Trading Signals

Forex trading signals can broadly be categorized into two main types: manual signals and automated signals.

1. Manual Forex Signals

Manual forex signals are generated by experienced traders or analysts who analyze market trends, indicators, and news events. These professionals use their expertise and intuition to suggest potential trades. Manual signals might include:

– Entry and exit points

– Stop-loss and take-profit levels

– Recommended trading pairs

Traders often appreciate the personal touch that manual signals provide, as they may come with detailed analysis or reasoning behind each trade recommendation.

2. Automated Forex Signals

Automated forex signals are produced by algorithms or trading systems that analyze vast amounts of market data to generate trade calls. These systems rely on pre-defined criteria, including technical indicators and historical patterns, to identify potential trades. The advantages of automated signals include:

– Speed: Automated systems can process data and execute trades faster than manual trading.

– Consistency: Algorithms operate without emotion, ensuring that trading strategies remain consistent over time.

– Accessibility: Automated signals can be accessed through various trading platforms and apps.

Traders can choose to follow automated signals generated by third-party services, or they can develop their own trading algorithms using tools available on the market.

Benefits of Using Forex Trading Signals

There are several key benefits of using forex trading signals as part of your trading strategy:

1. Improved Decision-Making

Forex trading signals can help traders make better decisions by providing timely information about market conditions. This can be especially beneficial in a volatile market where rapid movements can impact trades.

2. Time-Saving

Analyzing the forex market can be time-consuming. By relying on signals, traders can save time and focus on other aspects of their trading strategy.

3. Increased Profit Potential

Utilizing well-researched trading signals can potentially lead to higher profit margins. By following expert insights, traders may identify profitable opportunities that they might have otherwise missed.

4. Educational Value

Following forex signals can serve as an educational tool for novice traders. By analyzing the recommendations and the rationale behind them, traders can learn to recognize patterns and develop their own strategies over time.

How to Choose Reliable Forex Trading Signals

When it comes to choosing forex trading signals, the quality of the source is paramount. Here are some tips to help you select reliable signals:

1. Track Record

Research the performance history of the signal provider. A reliable service will have an established track record of successful trades. Look for providers who share their results transparently.

2. Market Reputation

Check reviews and testimonials from other traders who have used the signal service. A good reputation in the trading community is often a strong indicator of reliability.

3. Cost vs. Value

While some trading signals are free, others may come at a cost. Evaluate the value provided by paid services compared to the potential benefits. Consider whether the expected performance justifies the expense.

4. Flexibility

A good signal service should cater to various trading styles (e.g., scalping, day trading, swing trading) and allow you to adapt the signals to your own strategies.

Integrating Forex Trading Signals into Your Strategy

Once you have chosen a reliable source for forex trading signals, it’s essential to integrate them effectively into your trading strategy. Here are some guidelines for doing so:

1. Combine Signals with Your Analysis

While trading signals can provide valuable insights, it’s important not to rely on them exclusively. Combine signals with your technical and fundamental analyses to make well-informed decisions.

2. Manage Your Risk

Always use risk management strategies, such as setting stop-loss orders and maintaining a balanced risk-reward ratio. This will help you protect your capital while following trading signals.

3. Continually Learn and Adapt

The forex market is constantly evolving, and successful traders adapt to changing conditions. Use trading signals as a learning tool and continuously refine your strategy based on your experiences.

4. Practice Patience

Not every signal will lead to a winning trade. It’s important to remain patient and disciplined, following your strategy without letting emotions dictate your decisions.

Conclusion

Forex trading signals are powerful tools that can enhance your trading strategy, providing insights that lead to more informed decisions. By understanding the different types of signals available and how to effectively utilize them, you can increase your chances of success in the forex market. Always choose reliable sources, combine signals with your analysis, and continue to learn as you navigate this dynamic trading landscape.

As you explore the world of forex trading, consider leveraging the resources offered by various platforms, such as the reliable options available on Trading Platform TH. They can provide you with the necessary tools to track signals and execute trades seamlessly. Happy trading!