Understanding Forex Trading: A Comprehensive Definition

Forex trading, short for foreign exchange trading, refers to the global decentralized market where currencies are bought and sold. This market is the largest in the world, with a daily trading volume that exceeds $6 trillion. Forex trading involves the exchange of one currency for another in a bid to profit from fluctuations in exchange rates. In this article, we will delve deep into the definition of Forex trading, its mechanisms, key concepts, trading strategies, and effective platforms. For those looking to engage in Forex trading, knowing the forex trading definition Best Platforms for Trading is crucial for success.

Thank you for reading this post, don't forget to subscribe!The Basics of Forex Trading

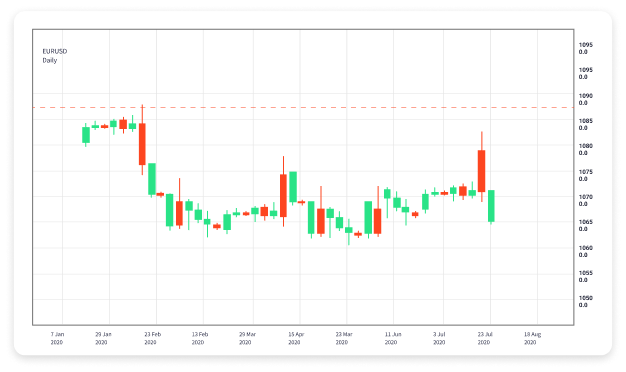

At its core, Forex trading revolves around currency pairs. Each pair consists of a base currency and a quote currency. For example, in the currency pair EUR/USD, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. The value of this pair tells you how much of the quote currency is needed to purchase one unit of the base currency. Understanding these pairs is fundamental to navigating the Forex market.

How Forex Trading Works

Forex trading operates on a network of banks, corporations, and individual traders who buy and sell currencies throughout the day. Trading takes place over-the-counter (OTC), which means transactions occur directly between parties without a centralized exchange. This allows for continuous trading, 24 hours a day, five days a week.

Traders use various tools and analysis techniques to predict currency movements. Technical analysis, which involves analyzing charts and historical price data, and fundamental analysis, which focuses on economic indicators, political events, and other factors affecting currency values, are two approaches commonly adopted by traders.

Key Players in the Forex Market

The Forex market is characterized by a variety of participants, including:

- Central Banks: They manage the nation’s currency and implement monetary policy.

- Commercial Banks: Large banks that facilitate currency trading for clients.

- Institutional Investors: Hedge funds and other large entities that participate for profit.

- Retail Traders: Individual traders using online platforms to trade currencies.

Understanding Pips and Leverage

A crucial concept in Forex trading is the “pip,” which stands for “percentage in point”. A pip is the smallest price move that a given exchange rate can make based on market convention. For most currency pairs, a pip is equivalent to 0.0001 of the exchange rate.

Leverage is another key element that allows traders to control larger positions with a relatively small amount of capital. For example, with a 100:1 leverage, a trader can control $100,000 with only $1,000. While leverage can amplify gains, it also increases the risk of significant losses.

Forex Trading Strategies

To succeed in Forex trading, one must adopt an effective strategy. Here are a few common strategies used by traders:

- Day Trading: This strategy involves buying and selling currencies within the same trading day to exploit short-term price movements.

- Swing Trading: Swing traders hold positions for several days to benefit from expected price movements.

- Scalping: This involves making dozens or hundreds of trades in a day, aiming for small profits on each trade.

- Trend Following: Traders identify and follow the direction of market trends to maximize returns.

Risks and Considerations

While Forex trading can be lucrative, it comes with inherent risks. One primary concern is market volatility, which can lead to significant price fluctuations within short periods. Additionally, the use of leverage can amplify losses, making it essential for traders to manage their risk wisely through practices such as setting stop-loss orders.

Choosing a Forex Trading Platform

Selecting the right Forex trading platform is crucial for your trading success. Factors to consider include:

- Regulation: Ensure the platform is regulated by a reputable authority.

- Fees: Look for transparent pricing and commissions.

- User Experience: The platform should be user-friendly, with a good mobile interface.

- Tools and Resources: Access to analytical tools and educational resources can enhance trading performance.

Conclusion

In summary, Forex trading is a complex yet rewarding activity that requires a sound understanding of the market, effective strategies, and proper risk management. With the right approach and tools, traders can navigate this dynamic market to achieve their financial goals. As with any investment, continuous learning and practice are essential for success in Forex trading.